China Pesticide Industry Report, 2012-2015

May 08 2013

Pages: 95

Language: English

Price: Inquire

-

-

With years of experience of global agrochemical industry rep...

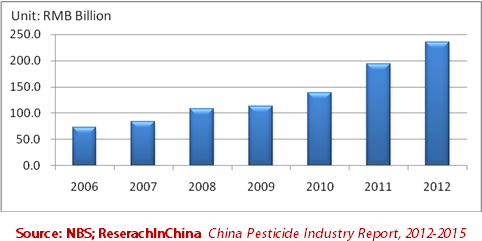

In recent years, China pesticide industry has showned sound development as a whole. In 2012, chemical pesticide API (converting into active ingredient) output of China increased by 34.0% year-on-year to 3.549 million tons, with the AAGR of 19.2% between 2005 and 2012. In 2012, the operating revenue of Chinese pesticide manufacturing surged by 21.2% year-on-year to RMB235.7 billion, while total profit reached RMB17.5 billion, presenting a 39.2% YoY rise.

Operating Revenue of Chinese Pesticide Manufacturing, 2006-2012

In the pesticide industry, international division of labor has been shaped, with developed countries specializing in the R&D and production of new pesticide varieties as well as the production of pesticide preparations while developing economics such as China emerging as production bases of pesticide API. The global pesticide market has been monopolized by the six industrial leaders including Syngenta, Bayer and BASF, the combined market share of which approximates 85%. There are more than 2,000 pesticide makers in China, featuring low market concentration. For example, the operating revenue of domestic industrial players in 2012 such as Zhejiang Xinan Chemical Industrial Group, NANJING RED SUN and Jiangsu Yangnong Chemical hit RMB2.8321 billion, RMB2.7252billion and RMB2.0566 billion, respectively, occupying 1.2%, 1.2% and 0.9% in terms of market share.

Chinese pesticide companies are increasingly sharpening their edges through M&As, product mix adjustment and capacity expansion. As a result of pressing environmental protection call and anti-dumping investigation, the prices of pesticide commodities such as glyphosate and pyridine derivatives has been on a stable growth, greatly benefitting pesticide producers including Zhejiang Xinan Chemical Industrial Group, NANJING RED SUN, HUBEI SANONDA, and Jiangsu Yangnong Chemical. In addition, there is a small number of enterprises in the production of minor-use pesticides, but they enjoy higher profit margin. And some domestic players, such as Huapont-Nutrichem, become suppliers of API (like metolachlor, Tebuconazole, and Azoxystrobin) for international tycoons including Bayer and BASF.

The report highlights the followings:

?Production, Sales, Import & Export and Operation of China Pesticide Industry;

?Production, Sales, Import & Export and Operation of China Pesticide Industry;

Competition in the Pesticide Industry: Market Competition Pattern in China and Beyond, Industry Entry Barriers, and M&As;

Competition in the Pesticide Industry: Market Competition Pattern in China and Beyond, Industry Entry Barriers, and M&As;

Development Environment: Industry Supervision Policy, Industry Policy, Industry Chain, Upstream and Downstream Sectors;

Development Environment: Industry Supervision Policy, Industry Policy, Industry Chain, Upstream and Downstream Sectors;

Development Prospect: Production Pattern, Production Structure, Market Demand, Industrial Polices and Others

Development Prospect: Production Pattern, Production Structure, Market Demand, Industrial Polices and Others

Production, Operation, Investment, M&A, Pesticide Business and Development Outlook of 12 Chinese Pesticide Companies.

Production, Operation, Investment, M&A, Pesticide Business and Development Outlook of 12 Chinese Pesticide Companies.

1. Overview of Pesticide Industry

1.1 Definition

1.2 Classification

1.3 Industry Chain

2. Status Quo of China Pesticide Industry

2.1 Production

2.1.1 Pesticide API Output

2.1.2 Pesticide Preparation Output

2.1.3 Output by Region

2.2 Sales

2.3 Import & Export

2.3.1 Import

2.3.2 Export

2.3.3 Import/Export Prices

2.4 Operation

2.4.1 Number of Industrial Players

2.4.2 Revenue

2.4.3 Profit

2.5 Competition Pattern

2.5.1 International Market

2.5.2 Chinese Market

2.6 Entry Barriers

2.6.1 Strict Administrative Licensing

2.6.2 Higher Capita Barrier

2.6.3 Environmental Protection-related Bars

2.6.4 Obstacles in Introducing Advanced Technologies

2.6.5 Market Entry Barriers

3. Development Environment of China Pesticide Industry

3.1 Policy Environment

3.1.1 Regulatory Policy

3.1.2 Industrial Policy

3.1.3 Industrial Standard

3.2 Upstream/Downstream Sectors

3.2.1 Upstream

3.2.2 Downstream

4. Development Outlook of China Pesticide Industry

4.1 Pesticide API Capacity Transferring to China

4.1.1 Chinese Players Specializing in “Generic Drugs” Production

4.1.2 Low-cost Edge Backing Industry Transferring

4.2 Robust Demand Fueling Boom of Pesticide Industry

4.3 Supply in China Pesticide Market

4.3.1 Accelerating Industrial Integration, Improving Supply Capabilities

4.3.2 Structural Adjustment in API and Preparations Will Continue

4.4 Policy Tendency in China Pesticide Industry

4.4.1 Further Tight Policies are Expected

4.4.2 Environmental Protection Management will Gradually Become Normalized and Internationalized

5. Major Domestic Industrial Players

5.1 NANJING RED SUN

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Pesticide Business

5.1.6 Estimates and Outlook

5.2 Nantong Jiangshan Agrochemical & Chemicals

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Customers

5.2.6 Pesticide Business

5.2.7 Estimates and Outlook

5.3 Lier Chemical

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.4 R&D and Investment

5.3.5 Pesticide Business

5.3.6 Estimates and Outlook

5.4 Jiangsu Yangnong Chemical

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 Pesticide Business

5.4.6 Estimates and Outlook

5.5 Jiangsu Changqing Agrichemical

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Gross Margin

5.5.5 R&D and Investment

5.5.6 Pesticide Business

5.5.7 Estimates and Outlook

5.6 Zhejiang Xinan Chemical Industrial Group

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Gross Margin

5.6.5 Pesticide Business

5.6.6 Estimates and Outlook

5.7 Zhejiang Shenghua Biok Biology

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 Gross Margin

5.7.5 Customers

5.7.6 Pesticide Business

5.7.7 Estimates and Outlook

5.8 HUBEI SANONDA

5.8.1 Profile

5.8.2 Operation

5.8.3 Revenue Structure

5.8.4 Gross Margin

5.8.5 Pesticide Business

5.8.6 Estimates and Outlook

5.9 Jiangsu Huifeng Agrochemical

5.9.1 Profile

5.9.2 Operation

5.9.3 Revenue Structure

5.9.4 Gross Margin

5.9.5 R&D and Investment

5.9.6 Pesticide Business

5.9.7 Estimates and Outlook

5.10 Hunan Haili Chemical

5.10.1 Profile

5.10.2 Operation

5.10.3 Revenue Structure

5.10.4 Gross Margin

5.10.5 Pesticide Business

5.10.6 Estimates and Outlook

5.11 Huapont-Nutrichem

5.11.1 Profile

5.11.2 Operation

5.11.3 Pesticide Business

5.11.4 Estimates and Outlook

5.12 Lianhe Chemical Technology

5.12.1 Profile

5.12.2 Operation

5.12.3 Revenue Structure

5.12.4 Gross Margin

5.12.5 R&D and Investment

5.12.6 Estimates and Outlook

Selected Charts

- Classification and Main Varieties of Pesticides

- Pesticide Industry Chain

- Output of Chemical Pesticide API (equivalent to 100% Active Ingredient) in China, 2005-2012

- Output of Major Pesticide Products in China, 2005-2012

- Output Structure of Chemical Pesticide API (equivalent to 100% Active Ingredient) in China (by Region), 2012

- China's Insecticide Output Structure (by Region), 2012

- China's Herbicide Output Structure (by Region), 2012

- China's Bactericide Output Structure (by Region), 2012

- Sales-output Ratio of Chemical Pesticide API (equivalent to 100% Active Ingredient) in China, 2005-2012

- Pesticide Import Volume in China, 2008-2012

- Pesticide Import Value in China, 2008-2012

- Pesticide Export Volume in China, 2008-2012

- Pesticide Export Value in China, 2008-2012

- Average Import and Export Prices of Pesticides in China, 2008-2012

- Number of Enterprises in China Pesticide Industry, 2006-2012

- Losses of China Pesticide Industry, 2006-2012

- Operating Revenue of China Pesticide Industry, 2006-2012

- Total Profit of China Pesticide Industry, 2006-2012

- Gross Margin of China Pesticide Industry, 2006-2012

- Pesticide Gross Margin of Major Companies in China Pesticide Industry, 2008-2012

- Global Pyridine Base Capacity and Distribution, 2010-2012

- Revenue of Major Companies in China Pesticide Industry, 2012

- Market Share of Major Companies in China Pesticide Industry, 2012

- Regulatory Policies and Main Content in China Pesticide Industry

- Major Policies on China Diagnostic Reagent Industry, 2005-2012

- Pesticide Patented Products Expired in China, 2012-2016E

- Pesticide Manufacturing Cost Comparison between China and European & American Countries, 2012

- Labor Cost Comparison between China and European & American Countries, 2012

- Investment and Projects in China Pesticide Industry, 2009-2012

- Output of Chemical Pesticide API in China, 2009-2016E

- Key Merger and Reorganization Events in China Pesticide Industry, 2008-2012

- Output of Main Pesticide Products in China, 2009-2016E

- Comparison between New Version Pesticide Management Regulations (Draft) and Old Version

- "Twelfth Five-Year Plan" of Pesticide Industry

- International Treaties in Global Pesticide Industry

- Chinese Pesticide-related Environmental Policies

- Revenue and Net Income of NANJING RED SUN, 2008-2012

- Revenue of NANJING RED SUN (by Product), 2008-2012

- Revenue of NANJING RED SUN (by Region), 2008-2012

- Gross Margin of NANJING RED SUN (by Product), 2008-2012

- Revenue and Net Income of Main Subsidiaries and Affiliated Companies of NANJING RED SUN, 2012

- Main Products, Capacity and Base Distribution of NANJING RED SUN, 2012

- Revenue and Net Income of NANJING RED SUN, 2011-2015E

- Revenue and Net Income of Nantong Jiangshan Agrochemical & Chemicals, 2008-2012

- Revenue of Nantong Jiangshan Agrochemical & Chemicals (by Product), 2008-2012

- Revenue of Nantong Jiangshan Agrochemical & Chemicals (by Region), 2008-2012

- Gross Margin of Nantong Jiangshan Agrochemical & Chemicals (by Product), 2008-2012

- Nantong Jiangshan Agrochemical & Chemicals' Revenue from Top 5 Clients and % of Total Revenue, 2008-2012

- Namelist and Revenue Contribution of Nantong Jiangshan Agrochemical & Chemicals' Top 5 Clients, 2012

- Non-fundraising Projects and Progress of Nantong Jiangshan Agrochemical & Chemicals, 2012

- Revenue and Net Income of Nantong Jiangshan Agrochemical & Chemicals, 2011-2015E

- Revenue and Net Income of Lier Chemical, 2008-2012

- Revenue of Lier Chemical (by Product), 2009-2012

- Revenue of Lier Chemical (by Region), 2009-2012

- Gross Margin of Lier Chemical (by Product), 2009-2012

- R&D Costs and % of Total Revenue of Lier Chemical, 2008-2012

- Production and Marketing of Clopyralid and Picloram of Dow AgroSciences, 2012

- Annual Capacity of Clopyralid and Picloram of Lier Chemical, 2012

- Revenue and Net Income of Lier Chemical, 2011-2015E

- Revenue and Net Income of Jiangsu Yangnong Chemical, 2008-2012

- Revenue of Jiangsu Yangnong Chemical (by Product), 2008-2012

- Revenue of Jiangsu Yangnong Chemical (by Region), 2008-2012

- Gross Margin of Jiangsu Yangnong Chemical (by Product), 2008-2012

- Main Products and Capacity of Jiangsu Yangnong Chemical, 2012

- Revenue and Net Income of Jiangsu Yangnong Chemical, 2011-2015E

- Revenue and Net Income of Jiangsu Changqing Agrichemical, 2008-2012

- Revenue of Jiangsu Changqing Agrichemical (by Product), 2010-2012

- Revenue of Jiangsu Changqing Agrichemical (by Region), 2010-2012

- Gross Margin of Jiangsu Changqing Agrichemical (by Product), 2010-2012

- R&D Costs and % of Total Revenue of Jiangsu Changqing Agrichemical, 2008-2012

- Main Products and Capacity of Jiangsu Changqing Agrichemical, 2012

- Revenue and Net Income of Jiangsu Changqing Agrichemical, 2011-2015E

- Revenue and Net Income of Zhejiang Xinan Chemical Industrial Group, 2008-2012

- Revenue of Zhejiang Xinan Chemical Industrial Group (by Product), 2008-2012

- Revenue of Zhejiang Xinan Chemical Industrial Group (by Region), 2008-2012

- Gross Margin of Zhejiang Xinan Chemical Industrial Group (by Product), 2008-2012

- Progress of Investment Projects of Zhejiang Xinan Chemical Industrial Group, 2012

- Revenue and Net Income of Zhejiang Xinan Chemical Industrial Group, 2011-2015E

- Revenue and Net Income of Zhejiang Shenghua Biok Biology, 2008-2012

- Revenue of Zhejiang Shenghua Biok Biology by Product, 2008-2012

- Revenue of Zhejiang Shenghua Biok Biology by Region, 2008-2012

- Gross Margin of Zhejiang Shenghua Biok Biology by Product, 2008-2012

- Zhejiang Shenghua Biok Biology's Revenue from Top 5 Clients and % of Total Revenue, 2008-2012

- Namelist and Revenue Contribution of Zhejiang Shenghua Biok Biology's Top 5 Clients, 2012

- Revenue and Net Income of Zhejiang Shenghua Biok Biology, 2011-2015E

- Main Product Systems of HUBEI SANONDA, 2012

- Revenue and Net Income of HUBEI SANONDA, 2008-2012

- Revenue of HUBEI SANONDA by Product, 2008-2012

- Revenue of HUBEI SANONDA by Region, 2008-2012

- Gross Margin of HUBEI SANONDA by Product, 2008-2012

- Capacities of Major Products of HUBEI SANONDA, 2012

- Revenue and Net Income of HUBEI SANONDA, 2011-2015E

- Revenue and Net Income of Jiangsu Huifeng Agrochemical, 2008-2012

- Revenue of Jiangsu Huifeng Agrochemical by Product, 2008-2012

- Revenue of Jiangsu Huifeng Agrochemical by Region, 2008-2012

- Gross Margin of Jiangsu Huifeng Agrochemical by Product, 2008-2012

- R&D Costs and % of Total Revenue of Jiangsu Huifeng Agrochemical, 2008-2012

- Major Products and Capacities of Jiangsu Huifeng Agrochemical, 2012

- MajorProchloraz Production Areas and Companies Worldwide, 2012

- Registration of Domestic Epoxiconazole Companie

- Revenue and Net Income of Jiangsu Huifeng Agrochemical, 2011-2015E

- Revenue and Net Income of Hunan Haili Chemical, 2008-2012

- Revenue of Hunan Haili Chemical (by Product), 2008-2012

- Revenue of Hunan Haili Chemical (by Region), 2008-2012

- Gross Margin of Hunan Haili Chemical (by Product), 2008-2012

- Progress of Non-fundraising Projects of Hunan Haili Chemical, 2012

- Revenue and Net Income of Hunan Haili Chemical, 2011-2015E

- Revenue and Net Income of Huapont-Nutrichem, 2008-2012

- Pesticide Business Segments of Huapont-Nutrichem, 2012

- Revenue Structure of Nutrichem (by Business), H1 2012

- Revenue of Pesticide Subsidiaries of Huapont-Nutrichem, 2011

- Pesticide Production Lines under Planning and Construction of Huapont-Nutrichem, 2012

- Investment Projects in Non-public Additional Issuance Plan of Huapont-Nutrichem, 2012

- Existing and Reserved Pesticide API Products of Huapont-Nutrichem, 2012

- Revenue and Net Income of Huapont-Nutrichem, 2011-2015E

- Production Bases of Lianhe Chemical Technology, 2012

- Revenue and Net Income of Lianhe Chemical Technology, 2008-2012

- Revenue of Lianhe Chemical Technology (by Product), 2008-2012

- Revenue of Lianhe Chemical Technology (by Region), 2008-2012

- Gross Margin of Lianhe Chemical Technology (by Product), 2008-2012

- R&D Costs and % of Total Revenue of Lianhe Chemical Technology, 2008-2011

- Revenue and Net Income of Lianhe Chemical Technology, 2011-2015E

Related Companies

- Nanjing Redsun Co.,Ltd.(000525.SZ)

- Nantong Jiangshan Agrochemical&Chemicals Co.Ltd(600389.SH)

- Lier Chemical Co.,Ltd.(002258.SZ)

- Jiangsu Yangnong Chemical Co.,Ltd.(600486.SH)

- Jiangsu Changqing Agricultureal And Chemical Co.,Ltd.(002391.SZ)

- Zhe Jiang Xinan Chemical Industrial Group Co.,Ltd.(600596.SH)

- Zhejiang Shenghua Biok Biology Co.,Ltd.(600226.SH)

- Hubei Sanonda Co.,Ltd.(000553.SZ)

- JIANGSU HUIFENG AGROCHEMICAL Co., Ltd.(002496.SZ)

- Hunan Haili Chemical Co.,Ltd.(600731.SH)

- Chongqing Huapont Pharm. Co.,Ltd.(002004.SZ)

- Lianhe Chemical Technology Co.,Ltd.(002250.SZ)

You might also like

-

2017-06-05

Pages:111

Language:

English

Publisher:

Terry

Free

-

Free

-

2017-07-17

Pages:9

Language:

English

Publisher:

Terry

Free

-

2011-11-21

Pages:0

Language:

English

Publisher:

Terry wong

Free

-

2016-12-06

Pages:162

Language:

English

Publisher:

Industry ARC

Free

-

Free

-

2023-04-29

Pages:1

Language:

English

Publisher:

Cocoly Alan

Free

-

Free